1/ Tons of ponzis there, but all fall into 3 types: Mining, Pooling, Splitting (in short Sanpan, 三盘 – three ponzis) Every ponzi ever existed is a standalone or a blend of the 3. Every type has its own pros & cons, methodology, & exit model

1/ 庞氏骗局有很多,但都分为 3 种类型:挖矿、池化、分裂(简称三盘,三盘-三个庞氏骗局)曾经存在的每一种庞氏骗局都是独立的或三者的混合体。每种类型都有自己的优缺点、方法论和退出模式

2/ So what exactly are the Sanpan?

Mining: A lump sum upfront irredeemable investment, & get linear rewards over time

Pooling: Redeemable temporary liquidity provision for interest rewards

Splitting: Split one investment subject into many so more capital injection for lower price

2/ 那么三盘到底是什么?

挖矿:一次性不可赎回的前期投资,并随着时间的推移获得线性奖励;

集合:可赎回的临时流动资金以获取利息奖励;

分拆:将一个投资主体拆分为多个投资标的,注资越多,价格越低

3/ Regardless of type, the true nature of a ponzi = mismatching capital allocation wif yield(money wif short term profit expectation for return with longer maturity)

From you, a PONZI MASTER’s POV, your profit is determined by how big and how long your mismatch can be

3/ 无论何种类型,庞氏骗局的本质 = 资本配置与收益率的不匹配(资金与短期利润预期的长期回报)

从庞氏大师的角度来看,您的利润取决于您的不匹配程度和持续时间

4/ So the real question is: how to keep money in and keep it coming?

This comes to answering the following three questions:

– Is there a substantial sunk cost?

– Level of need for liquidity?

– Is there a promised yield?

4/ 所以真正的问题是:如何留住资金并持续流入?

这涉及到回答以下三个问题:

– 是否存在大量的沉没成本?

– 流动性需求水平?

– 有承诺的产量吗?

三盘人有自己不同的做法:

5/ In Three Ponzi Problem, my main point is ‘how to recreate ponzi’. Therefore, the fundamental assumption is: I, as the creator, must maximize my profit.

Every ponzi would collapse, so before designing one, I have to understand my exit strategy, or in other words, when to exit?

5/ 在《三个庞氏骗局》中,我的主要观点是“如何重新创造庞氏骗局”。 因此,基本的假设是:我作为创造者,必须最大化我的利润。

每一个庞氏骗局都会崩溃,所以在设计庞氏骗局之前,我必须了解我的退出策略,或者换句话说,什么时候退出?

6/ To understand this, you need to look at the 3 key metrics of a ponzi:

– Deposit: How much $is depositing into your pocket?

– Withdraw: How much $ is withdrawn or taken from your pocket?

– Reward: How much profits generated from deposits that users could take from your pocket

6/ 要理解这一点,您需要了解庞氏骗局的 3 个关键指标:

– 存款:有多少美元存入您的口袋?

– 提款:从您的口袋中提取或取出了多少美元?

– 奖励:用户可以从你的口袋里拿走存款产生的利润有多少

7/ Ponzis don’t collapse when Reward > Deposit. It collapses when Withdrawal> Deposit

So when a signal of Withdrawal > Deposit emerges and would not correct, it’s time for you to cash out and rug everyone directly or indirectly (a topic we reserve for later)

7/ 庞氏骗局在奖励>存款时不会崩溃。 当提款>存款时崩溃

所以当出现提现>充值的信号并且无法纠正的时候,你就该提现了,直接或者间接的哄骗大家(这个话题我们留待后面)

8/ Before exiting, operating a ponzi is a money game for you to balance between:

– Reserve: Funds from deposits reserved for withdrawal for a certain period of time)

– Inflation: Rewards generated/ Total Deposits.

– Marketing Cost: The Cost to onboard/retain channels & “users”

8/ 在退出之前,经营庞氏骗局是一场金钱游戏,需要你在以下方面取得平衡:

– 储备金:存款中预留一定时间提取的资金)

– 通货膨胀:产生的奖励/总存款。

– 营销成本:建立/保留渠道和“用户”的成本

9/ Time has changed. Conventional MLMs are overtaken by crypto. Ponzi enjoyors have also evolved significantly over years. They more likely to hate:

– long lockup & high tax

– no or low liq

– low comparable rewards

so as a ponzi masster, you gotta adapt

9/ 时代变了。 传统的传销已被加密货币取代。 多年来,庞氏骗局的享受者也发生了显着的变化。 他们更可能讨厌:

– 长期锁定和高税收

– 无液或低液

– 较低的可比奖励

所以作为庞氏骗局大师,你必须适应

10/ From Mining to Pooling to Splitting, it makes a spectrum of risk preference from being a low risk bond investor towards being a high risk stock investor as per tradfi world

So much for the basic framework of Three Ponzi Problem

Next, how we build a Mining ponzi?

10/ 根据 tradfi world,从挖矿到池化再到分拆,它制定了从低风险债券投资者到高风险股票投资者的一系列风险偏好

三个庞氏问题的基本框架就讲这么多

接下来,我们如何构建一个挖矿庞氏骗局?

11/ Let’s take $Mobile’ s case. Their flywheel goes like this:

– users buy hotspot miner

– proceeds from sales go to LP to buy token(on low liq dex)

– price goes up →more miner buying

– pumps price higher

– higher price, higher volume, bigger CEX listing

– dev dump more

11/ 我们以$Mobile 为例。 他们的飞轮是这样的:

– 用户购买热点矿机

– 销售收益转给有限合伙人购买代币(在低流动性指数上)

– 价格上涨→更多矿工购买

– 泵的价格更高

– 更高的价格、更高的交易量、更大的CEX上市

– 开发转储更多

12/ Try to apply the model aforementioned:

1. Buying miner + reinvestment like electricity = Sunk Cost – regardless of price they have to stay

2. Part of proceeds goes to LP to buy back = Reserve

3. Started at dex so to keep liq & price low to establish dev position

4. token emission at diminishing/ halving speed so dev or MM can establish token holding superiority over latecomers – so they can talk to bigger CEXs for listing.

When dev want more sale, they easily pump w little cost in dex. 1x pump could = 5x more miner sale

12/ 尝试应用上述模型:

1.购买矿机+电力等再投资=沉没成本-无论价格如何,他们都必须留下来

2. 部分收益归LP回购=储备金

3. 从 dex 开始,保持流动性和价格较低,以建立开发地位

4. 代币发行速度递减/减半,因此开发者或MM可以建立相对于后来者的代币持有优势 – 这样他们就可以与更大的CEX进行上市

当开发人员想要更多销售时,他们可以轻松地以很少的 dex 成本进行拉动。 1 倍泵可以 = 5 倍更多的矿工销售

13/ So even dev makes a loss in Dex, they get it back on miner sale.

The rational FDV = total sunk cost. So more sale, more holders, higher FDV

From $Mobile’s website, we know the vesting plan goes like this for mining. There’s a 50B premine.

13/ 因此,即使开发者在 Dex 上遭受损失,他们也可以通过出售矿工来收回损失。

理性FDV = 总沉没成本。 因此,更多的销售、更多的持有者、更高的 FDV

从 $Mobile 的网站上,我们知道挖矿的兑现计划是这样的。 有一个 50B 的预挖。

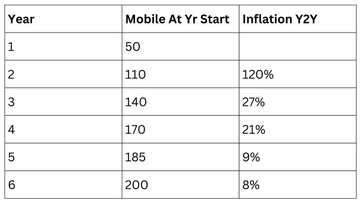

If we assume Mobile held major miners e.g. in Miami, and thereby controls 50% of token emission, then by Aug 2023, the actual circulating supply was only 30B at a price of $0.00026 ~ $780k

If the structure of mining power remains unchanged til Aug 2024 wif price at $0.0041,

如果我们假设 Mobile 持有主要矿商,例如 位于迈阿密,从而控制了 50% 的代币发行量,那么到 2023 年 8 月,实际流通供应量仅为 30B,价格为 $0.00026 ~ $780k

如果到2024年8月算力结构保持不变,价格为0.0041美元,

the new annual selling pressure = $12m. Given a Bobcat miner price at $450 and a $9m/day trading volume of $Mobile, all we need is 6700 new miner sale to balance out

This was calculated at Dec 2023 w 4835 hotspot count. Now it’s 14470. $mobile price stablized successfully

新的年度抛售压力= 1200 万美元。 鉴于 Bobcat 矿机价格为 450 美元,$Mobile 的交易量为 900 万美元/天,我们需要的只是出售 6700 台新矿机来平衡

这是根据 2023 年 12 月热点数量 4835 个计算得出的。 现在是14470.$mobile价格成功稳定

If you broaden my definition of Mining ponzi, Bitcoin itself and Ethereum POW era were also mining ponzi schemes. The only difference here is from Satoshi’s perspective, he didn’t need any Reserve or providing liquidity. So it was not his ponzi

But to Bitmain, it’s different

如果你扩大我对庞氏挖矿的定义,比特币本身和以太坊 POW 时代也是挖矿庞氏骗局。 这里唯一的区别是从中本聪的角度来看,他不需要任何储备或提供流动性。 所以这不是他的庞氏骗局

但对于比特大陆来说,情况就不一样了

When ASIC miner manufacturers like Bitmain started selling miners, they became the ponzi master. And it followed the same flywheel & liq expansion route as I described above

Follow the same path, you may find many POW coins are more “MMed” than you thought (eg. $KAS, $SMH)

当像比特大陆这样的 ASIC 矿机制造商开始销售矿机时,他们就成为了庞氏骗局。 它遵循与我上面描述的相同的飞轮和液体扩展路线

遵循同样的路径,你可能会发现许多 POW 币比你想象的更“MMed”(例如 $KAS、$SMH)

To summarise, to start a Mining Ponzi, you need:

– make sure there’s a Sunk Cost + Reinvestment

– maximize total no. of ppl &value of Sunk Cost

– start w low liq venue

– form the flywheel ( dev, or in the name of a 3rd party eg. miner provider)

– timing that allow slow ponzi

总而言之,要开始挖矿庞氏骗局,您需要:

– 确保有沉没成本+再投资

– 最大化总数 人口数量和沉没成本价值

– 从低液体场地开始

– 形成飞轮(开发者,或以第三方的名义,例如矿工提供商)

– 允许缓慢庞氏骗局的时机

If you a retailer, to participate in a Mining scheme, do make sure:

– the ratio of token FDV & total Sunk Cost (unit cost of miner * number) is low

– you join wen: Miner Sale + Token Volume > Emitted circulating supply & in a low liq venue

– sell when listed in bigger CEXs

如果您是零售商,要参与挖矿计划,请务必确保:

– 代币FDV与总沉没成本(矿工单位成本*数量)的比率较低

– 你加入文:矿工销售 + 代币数量 > 排放的流通供应量和低流动性场所

– 在较大的中心交易所上市时出售

Also, Mining doesn’t have to mean it must be POW mining. It could be most of POS-staking blockchains, most non-casino crypto games, veCRV with lockup requirements

You really have to see through their veil and call them by their right names

此外,挖矿并不一定意味着它必须是 POW 挖矿。 可能是大多数 POS 质押区块链、大多数非赌场加密游戏、有锁仓要求的 veCRV

你真的必须看穿他们的面纱并用正确的名字称呼他们

以上内容来源于:X :加密韋馱